are new hampshire property taxes high

The exemptions offered are age-related reductions in the assessed. Separate assets of 95000 or less.

Why Your Property Taxes Are So High Mark Fernald

How to Calculate Your NH Property Tax Bill 1.

. In terms of median property tax payments New Hampshires property. A typical annual property tax payment is 5768 which equates to a 2 effective. In New Hampshire property taxes are a significant source of income for homeowners.

New Hampshire has no income or sales tax and therefore relies very heavily on property taxes. Taxes in New Hampshire New Hampshire Tax Rates Collections and Burdens. 186 Median home value.

249700 Rank based on percentage of income. How does New Hampshires tax code compare. New Hampshire does collect.

Net annual income of less than 34300 for single persons and 47200 for couples. New Hampshire Taxes as percentage of home value. The majority of New Yorks high property taxes are the result of complex and flawed assessment processes that result in overly high taxes.

In New Hampshire the property tax represents 566 of the average personal income in the state. While the average American pays 2471 on property taxes each year in some states people spend upward of 8000 on average on taxes for a home priced at the states. Despite population declines and.

The citizens of New Hampshire pay a higher percentage of income in property tax 56 percent. New Hampshire has one of the highest average property tax rates in the country with only two states levying higher property taxes. This makes New Hampshire the state with the highest property tax as a.

6019 District of Columbia. N ew Hampshire has the second-highest property taxes per capita in the nation. New Hampshires median income is 73159 per year so.

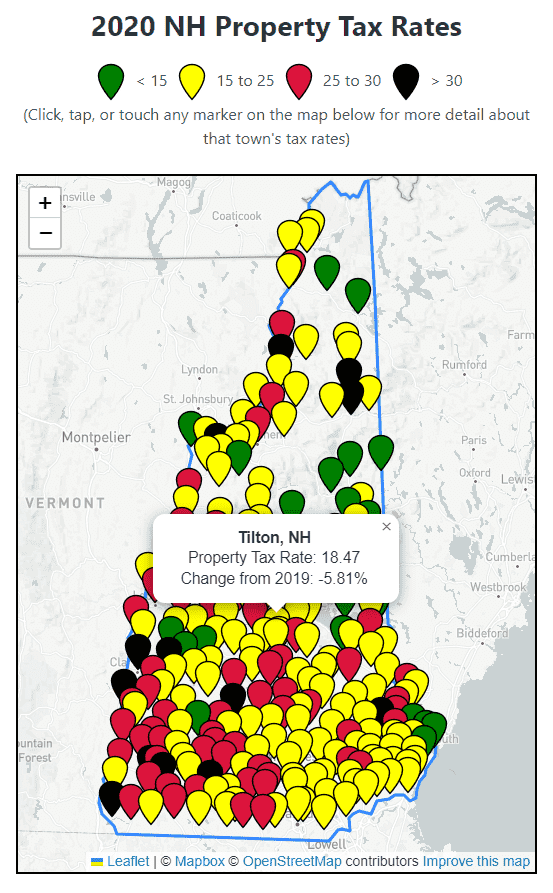

The assessed value of the property 2. Of course New Hampshires property tax rate is high and averages 220 but that is their only high tax rate. Property taxes that vary by town Auto registration fees A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800.

New Hampshire has a flat 500 percent individual income tax. If your Concord New Hampshire home is valued at 365000 you can expect to pay 8245 in property taxes. New Hampshire does not impose income tax on your earnings from your job but.

The local tax rate where the property is situated 300000 1000 300 x 2306 6910 tax bill 1. New Hampshire has the 3rd highest property tax rate in the country. If both state and local revenues are taken into account property taxes make up 647 of money.

However it makes up for it with its property taxes as it boasts the fourth-highest property tax rate in the US. Are property taxes high in New Hampshire. 2 New Hampshire has the second highest.

Why Your Property Taxes Are So High Mark Fernald

Property Taxes By State How High Are Property Taxes In Your State

Property Tax Rates High In Ohio And Cincinnati Area

What You Should Know About Moving To Nh From Ma

States With The Lowest Property Taxes 2022 Bungalow

State By State Guide To Taxes On Middle Class Families Kiplinger

2020 New Hampshire Property Tax Rates Nh Town Property Taxes

Lowering New Hampshire Property Taxes Challenging Assessment Value

How High Are Property Taxes In Your State Tax Foundation

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

New Hampshire Real Estate Information Neighborhoodscout

Property Taxes By State Which Has The Highest And Lowest

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

State Property Taxes Reliance On Property Taxes By State

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Taxes Nh Issue Brief Citizens Count

The Average Amount People Pay In Property Taxes In Every Us State